-

Who We Are

Who We Are

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses the most powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

Madison, Wisconsin storefront of Pittsburgh Plate Glass Company (now PPG), founded by John Pitcairn, Jr.

Madison, Wisconsin storefront of Pittsburgh Plate Glass Company (now PPG), founded by John Pitcairn, Jr.

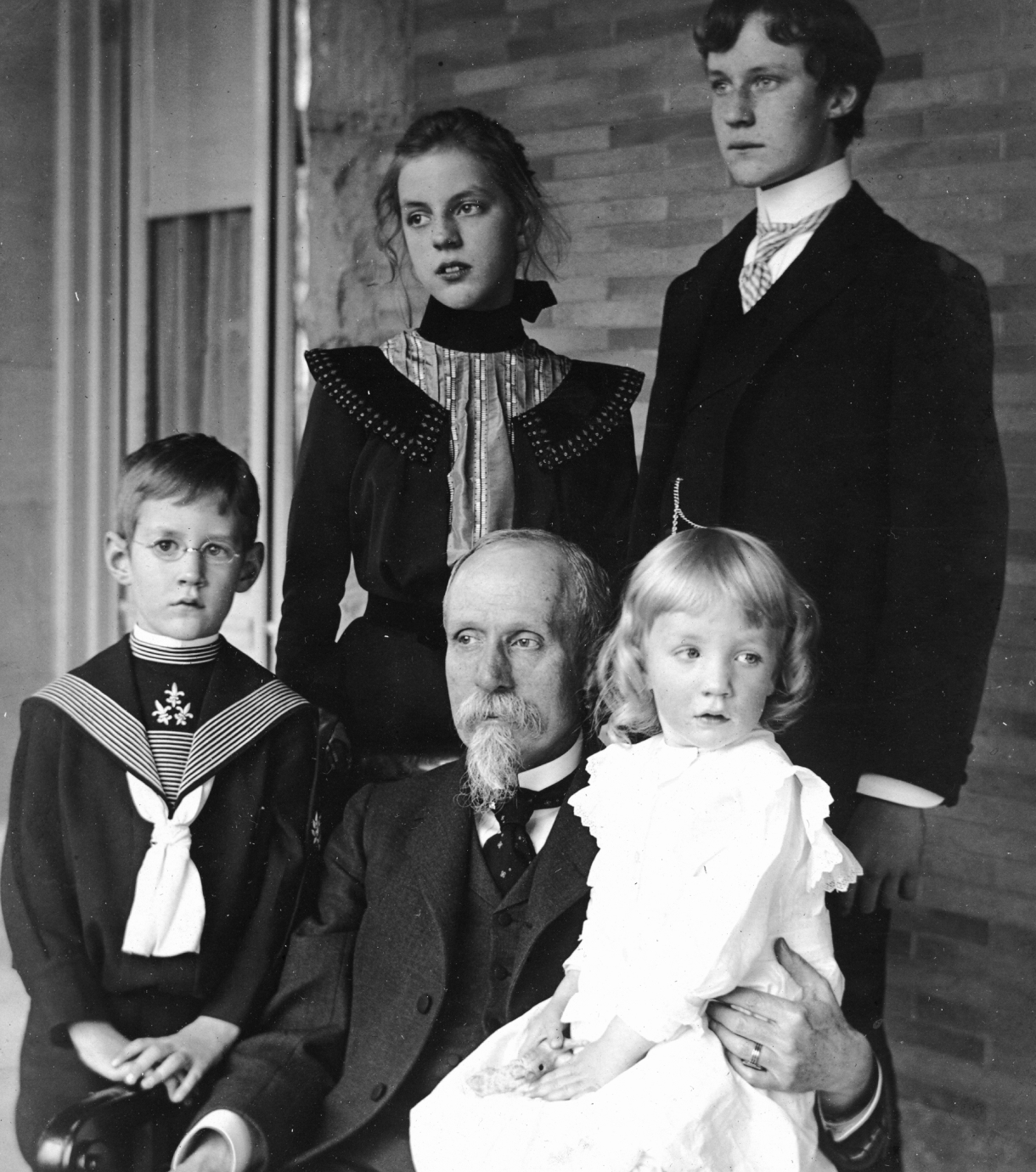

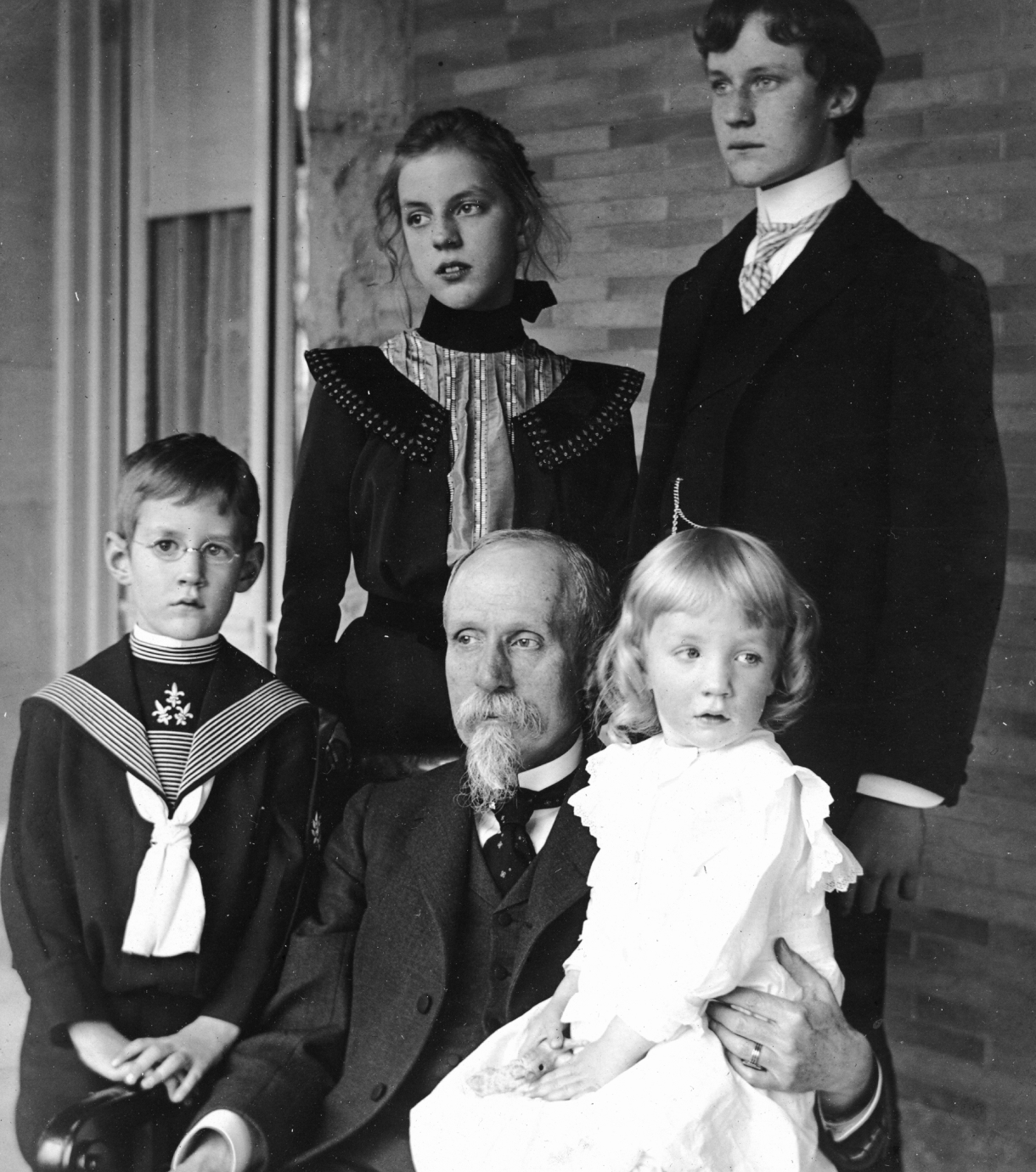

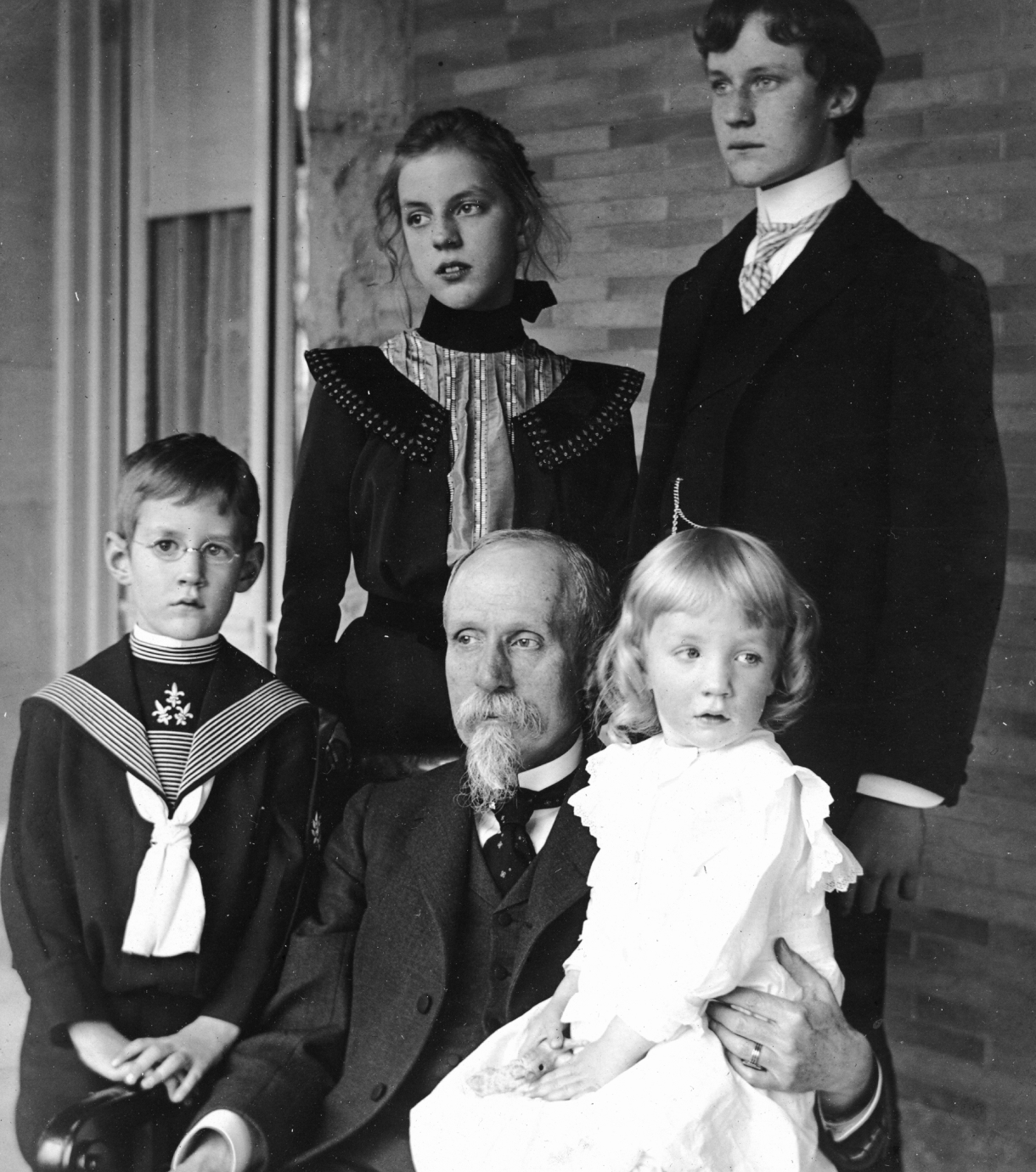

John Pitcairn, Jr. with his children Raymond, Vera, Theodore, and Harold.

1883

With capital he accumulated from investment partnerships in natural gas, John Pitcairn, Jr. co-founds Pittsburgh Plate Glass Company (PPG). PPG goes on to dominate the U.S. glass market by exploiting superior European glass-production methods.

1900

PPG begins diversifying into other products, becoming the nation’s second-largest producer of paint. The company’s stunning success enables John to become an early private equity investor, with stakes in manufacturing, banking, chemicals, and even sugar.

1905

Recognizing the importance of clear-eyed succession planning, John taps a non-family executive as the person best suited to succeed him as head of PPG. This enables the three sons he fathered with his wife, Gertrude—Raymond, Theodore, and Harold—to pursue their own callings in such diverse fields as architecture, theology, and aviation.

1916

John Pitcairn, Jr. dies, leaving his assets to be divided among his three sons and their families.

Brothers Raymond and Theo Pitcairn.

President Dwight D. Eisenhower visits Cairnwood Estate in Bryn Athyn, PA. | Harold F. Pitcairn receives the Collier Trophy in 1930 for his development and application of the autogiro.

President Dwight D. Eisenhower visits Cairnwood Estate in Bryn Athyn, PA.

1923

Raymond, Theodore, and Harold (who remain majority shareholders of PPG) establish The Pitcairn Company, which spares no expense in hiring the best tax lawyers, accountants, estate planners, and advisors to manage the affairs of their three households.

1950

With the three brothers each fathering nine children, the family grows rapidly. By 1950, The Pitcairn Company serves 61 direct descendants of John and Gertrude, not including spouses.

1958

Pitcairn Company president Raymond Pitcairn chooses his son-in-law, James “Jim” Jungé, as his successor, revealing an inclusive understanding of family enterprise that recognizes leadership potential beyond blood relatives. Jim immediately sets out to reshape the family office for the next generation.

Pitcairn was an early investor in the Quotron, a machine that delivered stock market quotes to an electronic screen.

Pitcairn was an early investor in the Quotron, a machine that delivered stock market quotes to an electronic screen.

James "Jim" Jungé, standing in front of a portrait of his father-in-law, Raymond Pitcairn, presents to shareholders, circa 1970.

1962

Under Jim Jungé, Pitcairn builds out an investment function on par with major banks and other wealth managers—remarkable for a single-family office at the time. Jungé also convinces fellow family members to re-invest their PPG dividends into the business, tripling the company’s share price.

1972

Recognizing the importance of portfolio diversification to the family’s long-term financial well-being, Jungé sees to it that Pitcairn replaces a big chunk of its PPG stock with stakes in real estate, venture capital, and private equity. For the first time, PPG stock accounts for less than 50 percent of Pitcairn’s assets.

1982

Pitcairn’s “auxiliary board,” later renamed the family council, is formed to democratize family governance and train the next generation of firm directors. Its architects stipulate that half of the family members who craft the board’s charter (and later join the board itself) should be women.

1986

Faced with the varied needs and asset levels of a growing multigenerational family, Pitcairn liquidates the family’s remaining PPG stock and restructures the holding company. This move enables diversified, long-term investing on a broader scale.

H.F. “Rick” Pitcairn, II, and Jim Jungé celebrate the firm's 75th anniversary in 1998.

H.F. “Rick” Pitcairn, II, and Jim Jungé celebrate the firm's 75th anniversary in 1998.

1987

The Pitcairn Trust Company is established and announces it will begin welcoming non-Pitcairn families as clients.

1989

Pitcairn launches the Family Heritage Fund, one of several new proprietary investment products, which recognizes the unique qualities of family businesses like PPG and Pitcairn itself. The fund delivers an annualized return of nearly 10 percent between 1989 and 2006.

1996

Pitcairn launches the National Philanthropic Trust (NPT), the brainchild of fourth-generation family member Clark Pitcairn, to manage and advise families’ charitable giving. NPT succeeds beyond anyone’s wildest dreams, with $15 billion given away over the next 15 years.

2004

H.F. “Rick” Pitcairn, II, a fourth-generation family member, joins Pitcairn on the investment team to explore open-architecture platform options.

The Pitcairn team celebrate a win at the 2018 Family Wealth Alliance Best in Industry Awards.

The Pitcairn team celebrate a win at the 2018 Family Wealth Alliance Best in Industry Awards.

Leslie Voth and Dirk Jungé in 2012.

2007

Board chairman Dirk Jungé, son of Jim Jungé, becomes Pitcairn’s CEO as the firm refocuses on the integrated and holistic set of services it can offer to multi-generational client families.

2008

Under the leadership of H.F. “Rick” Pitcairn, the firm recommits to being on the same side of the table as its clients, transitioning to an open-architecture investment platform. At the same time, it introduces an innovative, data-driven tax overlay program, which helps clients derive an extraordinary level of tax advantage from their portfolios.

2012

Leslie Voth becomes Pitcairn’s first female president and CEO, elevating women’s voices at the firm as she helps Pitcairn complete its transformation into a shared family office with a diverse professional staff and a growth mindset.

2017

Pitcairn unveils its Wealth Momentum® service model, which articulates the firm’s holistic approach to multigenerational wealth transfer.

Pitcairn's 100th anniversary celebration at the Barnes museum in Philadelphia.

President & CEO Andy Busser; Pitcairn hosts a classic car event in 2023.

President & CEO Andy Busser

2022

Pitcairn serves 110+ multigenerational families including 22 single-family offices, with roughly $7 billion in assets under advisement.

2023

Pitcairn reaches another milestone and celebrates its centennial anniversary. Leslie Voth announces her retirement and passes the CEO baton to Andy Busser, Pitcairn’s President of Family Office.

2024

Pitcairn announces a strategic partnership with Temperance Partners, a private investment firm backed by single family capital with a long-term orientation. This partnership and investment positions Pitcairn for continued growth, as well as future investments in technology, talent, and unique family office client experiences.